Programs and Services

CAPP's VITA program offers free tax preparation to residents who make less than $60k/year. The VITA program's 1040 Team will prepare and e-file taxes to help residents keep 100% of what is owed to them.

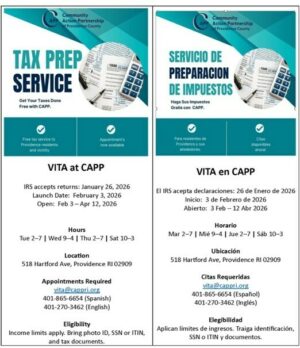

CAPP VITA starts February 3, 2026, through April 12, 2026/CAPP VITA comienza el 3 de febrero de 2026 y finaliza el 12 de abril de 2026

Tuesdays: 2pm - 7 pm Martes: 2 pm - 7 pm

Wednesdays: 9 am- 4pm Miercoles: 9 am - 4pm

Thursdays: 2 pm - 7 pm Jueves: 2 pm - 7 pm

Saturdays: 10 am - 3 pm Sabados: 10 am - 3 pm

Appointments Required/Citas Requeridas

Items you need to bring to the VITA/TCE sites to have your tax returns prepared:

- Proof of identification – Picture ID

- Social Security Cards for you, your spouse, and dependents or a Social Security Number verification letter issued by the Social Security Administration or

- Individual Taxpayer Identification Number (ITIN) assignment letter for you, your spouse, and dependents

- Proof of foreign status, if applying for an ITIN

- Birth dates for you, your spouse, and dependents on the tax return

- Wage and earning statement(s) Form W-2, W-2G, 1099-R, 1099-Misc from all employers

- Interest and dividend statements from banks (Forms 1099)

- A copy of last year’s federal and state returns if available

- Proof of bank account routing numbers and account numbers for Direct Deposit, such as a blank check

- Total paid for daycare provider and the daycare provider's tax identifying number (the provider's Social Security Number or the provider's business Employer Identification Number) if applicable

- To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms.

Residents will also need to fill out IRS intake form 13614-C. Volunteers can assist with this; it is available in English, Spanish, Chinese, Creole-French, Korean, Polish, Portuguese, Tagalog and Vietnamese. The nonresident intake form can be found HERE.

Social Security Cards

Individuals who need proof of their SSN and cannot locate their card, will need to apply for a *replacement card, which takes up to 14 business days.

- Replacement Card: Your Social Security card is legal proof of your Social Security number. If you need proof of your number, and you can’t find your card, you will need a replacement card. To get a replacement card, you must complete an Application for a Social Security Card – Form SS-5), which can be found online at www.socialsecurity.gov/ssnumber.

- Benefits Verification letter: If you need proof of Social Security or Supplemental Security Income benefits, you can get a benefit verification letter online instantly through a My Social Security account. However, Social Security offices will continue to provide verification letters until further notice.

Setting up a My Social Security account is easy. To create an account, an individual provides some personal information and answers to some questions that only they are likely to know. The next step is to create a username and password to access their online account. This process keeps personal Social Security information private.

Need assistance?